Executive Summary

The report focuses on preparation of an analysis of the organizational strategies of Unitech Products (BD) Ltd. The company is a Joint-Venture entity engaged in the manufacturing/assembly of a wide array of Heating Ventilation & Air Conditioning (HVAC) systems to cater to the domestic demand of the Bangladeshi Market. The core focus and primary operations of Unitech involve designing, manufacturing, installing, commissioning and providing maintenance services pertaining to industrial, commercial and household Air Conditioning Systems. Qualitative Analytical tools and intuitive methods of business deduction have been applied throughout the study.

Comprehensive analyses of the environment in which the business operates have been carried out and internal core strengths and weaknesses assessed. Strategic connotations of the various relevant variables affecting the overall organizational performance have been deduced and studied in detail. Finally, recommendations are provided on the basis of findings of the analyses, to be implemented in the next three years, in order for the organization to optimally flourish in the strategic context.

Introduction

Company Background

Unitech products (BD) Limited is a Private Limited Company by shares, established as a Joint-Venture entity, incorporated in Bangladesh with an authorized capital of BDT 200.00 million on December 20, 1999 (under Companies Act 1994). The portfolio of products offered by Unitech can be classified as:

- Air Conditioners

- Steel Furniture (Industrial & Household purposes)

- Light Sheds (Industrial & Household)

Assembly and manufacturing of Air Conditioners is the core business focus of the company, with periodic consignments of Steel Furniture and Light Sheds (exported as an auxiliary B-2-B venture) to a number of European destinations including Treco A/S, Aalestrup, Denmark.

The increasing demand for Air conditioners during the scorching and humid summers in Bangladesh has led to a rapid rise in the import of Air conditioners from various countries. Imported Air conditioners are considerably high priced owing to existing import duty structures. To cater to the increasing demand of the local market, Mr. Anis Ahmed, Managing Director and Chairman of Penguin Engineering Ltd. took the initiative of establishing an Air conditioner manufacturing company in Dhaka, Bangladesh. The Joint-venture emerged from an effective correspondence with Mr. Chung Miah Huat and Mr. Ong Chu Tek, partnership owners of Unitech Pte. Ltd, Singapore.

(Unitech, 2010)

Ownership Structure

Unitech Products (BD) Ltd. is a joint-venture business entity with 50% ownership (Equity) respectively of two organizations namely:

1) Penguin Engineering Ltd. (Bangladesh) → 50%

2) Unitech Products (Pte.) Ltd. (Singapore)→ 50%

i. Penguin Engineering Ltd.

Penguin Engineering Company is a renowned industrial/commercial HVAC system solutions provider operating in Bangladesh for more than a decade.

ii. Unitech Products PTE Ltd. (Singapore)

Unitech Pte. Ltd. has been operating as a manufacturer/exporter of A/C parts for thirty years. The foreign counterpart primarily provides raw materials, components, and Research & Development support for the joint-venture.

[Financial Statements of Unitech Products (BD) Ltd. are provided in the Appendices Section]

Product Portfolio

The current portfolio of Unitech Air Conditioners can be summarized as follows:

1) Window Type [cooling capacities of 1.5 tons to 2 tons]

2) Split Type:

- Wall Mountable [cooling capacities 1 to 2 tons]

- Ceiling Mountable [cooling capacities 1.5 to 5 tons]

3) Cassette Type [2 to 4 tons]

4) Duct Type [2 to 5 tons]

5) Floor Type [capacity of 4 tons only]

6) Package Type Air conditioner [capacities on order basis

Human Resources

Currently the company employs 111 people at two locations: The Head Office in Dhanmondi, Dhaka and the manufacturing premises at Kabirpur, Savar.

| |

Number of Employees |

|

Head Office

|

41 |

|

Manufacturing Site

|

70 |

|

Total

|

111 |

Key Strategic Issues

The Key strategic issues that the company faces over the next three years include the following:

- Stiff Price Competition from the competitors.

- Emergence of new players in the industry.

- Emergence of large conglomerates with substantial capital investment capabilities.

- Rising levels of duties/tariffs on imported components and raw materials.

- Increasing levels of price of energy (per unit electricity).

- Increasing levels of marketing communications requirements in order to reach potential target audiences.

The strategic issues are elaborated in the following sections and the recommendations to deal with the scenarios suggested in the Strategic Options and Recommendations section.

Organizational Objectives

Unitech currently does not have an organizational mission statement. The tagline for the products is: “Simply better living”. The initial broad vision of the company was: “Dedicated to excel in providing global standard HVAC systems solutions, and enable the majority of middle income groups to be able to afford locally assembled A/Cs.”

(Unitech, 2010)

PESTLE Analysis:

Political Factors:

Domestic political instability (arising from unrest i.e. friction between the political parties) has impacts upon operational performance of Unitech Ltd. Disruptions in the seamless flow in input raw materials and/or consignment transportation have clear repercussions upon the business performance since production schedules are hampered with negative effects upon demand patterns and foreign business relationships.

Economic Factors:

Economic factors such as Interest Rate, Exchange Rate, Corporate Tax rates and various Regulatory Tariffs (import/export tariffs, surcharges, excise, Customs Duty, Supplementary Duty, VAT etc.) have the most significant impact upon the business performance of Unitech Products (BD) Ltd. The business, owing to its intrinsic nature, has to rely heavily on imported raw materials and components to produce outputs i.e. air conditioners. Fluctuations in the rates of import tariff therefore have the highest intensity of financial repercussions upon the operational performance of Unitech.

The strategic maneuvering, in order to adapt to increased changes brought about by the aforementioned economic factors therefore remain the topmost priority for the company to sustain in the long run. Primary sources for procurement of various components of Air Conditioners are: Singapore, Thailand, China and Malaysia. Financial and operations management functions are therefore constantly striving to minimize freight costs and impacts of unfavorable exchange rate fluctuations. Strategic Supply Chain Management efforts are focused on opting for options that render a minimization of import tariffs and freight costs, with efforts to hedge against exchange rate fluctuations.

The business relies heavily on debt financing i.e. borrowing from financial institutions (banks) to finance various capital expenditure (investment) projects and working capital requirements. The prevailing interest rate in the banking sector is therefore tremendously significant since the company lacks the financial maneuverability of PLCs to raise funds through issuing equity/debt securities in the capital (or OTC) markets.

Corporate tax rate directly influences the net profit after tax figures and affect the firm’s capability to retain earnings for growth in the long run; and thereby is a crucial factor. Finally, inflation rate has impacts upon the overall performance of the firm, since escalating inflation rates cause a surge in price levels, thereby decreasing demand for the products and reducing profitability.

Social Factors:

Social factors such as shifts in the workforce, with massive inclusion of women, have positive repercussions upon the strategic objectives of Unitech. Economic growth is fostered through inclusion of previously inert sections of population, resulting in a rise of per capita GDP. This phenomenon increases standards of living, with rising demand for household appliances to augment comfort levels. Products such as A/Cs are increasingly perceived as ‘necessities’ rather than a ‘luxury’ by increased sections of the population.

Technological Factors:

Unitech strategically strives to reduce costs through capacity building measures by acquiring new technologies. Examples include: the recently acquired ‘Plastic Injection Machines’ to manufacture plastic components domestically (previously imported) to further reduce costs. Similar capital investment measures are underway necessary to increase productivity/efficiency, and cost reduction measures to decrease the price levels in an effort to cater to the demands of new market segments.

Legal Factors:

The legal frameworks within which Unitech Ltd operates can be perceived as a low-to-medium intensity of impact upon the business performance of the firm. Regulatory frameworks of Safety & Security for manufacturing employees are the most significant legal areas with lucid repercussions for the firm. The company tends to adopt a standard ‘best-practices’ approach to comply with the regulatory requirements, and did not face any adverse ramifications pertaining to legal/regulatory frameworks.

Ecological Factors:

Unitech tends to adhere to ecologically friendly standards in its operational approaches. The manufacturing process emphasizes on refraining from the use of CFC gases known to damage the ozone layer, and accelerate the phenomenon of global warming through ‘greenhouse effects’.

An Overview of the Competitive Environment of the Industry

Analysis of Porter’s Five Forces:

The following section focuses on an analysis of the competitive landscape of HVAC systems sector of Bangladesh using the Porter’s 5-forces framework.

Competitive Rivalry within the Industry:

Unitech is the first business entity to assemble complete A/C units domestically in Bangladesh. All other locally available units prior to the establishment of Unitech imported finished products from countries like: Japan, China, Thailand etc. Authorized local dealers/importers of renowned global brands like: General, LG, Haier, Panasonic, GE etc. were the primary competitors of Unitech in the Bangladesh market. Local dealers were primarily retailers/wholesalers, and lacked the depth of technical expertise that a full fledged manufacturing entity like Unitech possessed. The absence of capacity and capability in terms of human resources (e.g. experienced technicians/engineers) and equipments to provide optimum installation, commissioning and after-sales services enabled Unitech to quickly achieve substantial B-2-B market shares. Large scale A/C installation projects in industrial/commercial establishments (e.g. commercial buildings, banks, hospitals, universities etc) became Unitech’s domain of expertise. Delivery of prompt and precise services, through adept technical know-how, was an instant success among corporate clientele.

Currently the industry is dominated by a few major players. Walton, a Bangladeshi conglomerate has started a new assembling/manufacturing division. Global brands such as General, LG, Haier and Panasonic are popular choices in the household segments. It is notable that imported A/Cs are priced substantially above offers from Unitech and Walton, since domestic assembly provides a competitive edge through import tariff benefits. Import duty rates are significantly higher for finished A/C units than that of components/raw materials. Although recognition of global brands influence the purchase decision of certain market segments, core functional characteristics and price eventually determine buying patterns. Empirical results concur with this deduction, since an increase in demand for locally produced brands can be observed in the last decade.

Bargaining Power of Suppliers:

Unitech (Pte.) Ltd (Singapore) (with 50% ownership stake) is the primary supplier of Raw Materials and components. This vertical integration of the foreign supplier with the Bangladeshi manufacturer renders a strategic competitive edge for the operations of Unitech Ltd.

Bargaining Power of Customers:

Customers in the Air Conditioner industry of Bangladesh have a wide array of competing brands to choose from. It can be deduced that the bargaining power of customers is relatively high in this sector with high price elasticity of demand. This increases the overall competitiveness of the industry, and customers are benefited through the efforts of companies to minimize costs to maximize profit margins in an environment of stiff competition.

Threat of New Entrants:

There exists a strong probability of emergence of new players to enter this industry given the medium capital requirements, no barriers to entry, and relatively high profit margins. Probability of collusive behavior among the existing players in the market is low, given the number of sellers, and their strategic inclinations. Therefore, the threat of new entrants, is relatively high with the probability of strong players (e.g. conglomerates such as Walton) to enter the market.

Threat of Substitute Products:

Bangladesh is a country of tropical monsoon climate with very hot and humid weather throughout most of the year. Electric appliances such as cooling fans (ceiling or desktop versions) can be considered as substitutes, but are seldom considered to serve the purpose of A/Cs. The demand for A/Cs is thereby accelerating, given the high rates of urbanization and industrialization. As urban boundaries expand, constructions of new buildings take place, resulting in stimulation of demand for A/Cs. The threat of substitute products in this sector is therefore relatively low.

Organizational Core Competencies

The level of expertise, experience and technical know-how possessed by the entrepreneurs of Unitech can be identified as the most significant core competency of the organization. In the Bangladeshi context, there exists a dearth of experienced HVAC system experts, and the cohort of experienced human resources (technicians and engineers) at Unitech constitutes the most vital strategic resources.

The processes/machinery/equipment used at the manufacturing facilities can also be considered as distinct competencies. Unitech being the pioneer of utilizing such approaches to assemble HVAC systems in Bangladesh has accumulated an invaluable portfolio of skills and experiences. The joint-venture’s vertical integration with the supplier is another unique competency, which no other competitor currently possesses.

Collaborations and industrial strategic alliances with major commercial clients can be perceived as an aspect rendering unique strategic edges for Unitech. The strong business relationships that the company has built and nurtured following its inception can be considered as a key strategic resource for the firm, given its potential to influence future expected earning streams.

Leadership & Strategic Planning

Unitech Products Ltd. is the brainchild of the Managing Director Mr. Anis Ahmed (with 50% ownership stake through Penguin Engineering Ltd.) who initially envisioned the potential of success for an HVAC company with optimal supply chain, manufacturing and human resources. It is the strategic leadership of this individual that has escalated the brand recognition of Unitech through achieving substantial B-2-B market shares in this sector. The leadership style at Unitech might be perceived as one with Operations/Tactical orientation, with hands on involvement of senior management. The Aspirational/Visionary style is also observed from the phenomenon that the entrepreneur had the lucid vision of addressing the gap or the lack of domestic HVAC assembling industry prior to inception. It took a number of years for the new organization to attain its initial objectives of brand equity and profitability.

The importance of Strategic Leadership as theorized by Henry Mintzberg (1989) emphasizes strategy process to be explicit, conscious and controlled; and that the process must consider implementation techniques. Analysis → Choice → Implementation

(Westley & Mintzberg, 1989)

Strategic Planning efforts observed at Unitech Ltd. can be associated with Informal (cerebral) Planning Techniques and Strategic Analysis/Policy Options Planning as per the Approaches to Planning theorized by Taylor and Hussey. (Thompson & Martin, 2010).

A major weakness observed is the lack of a formalized comprehensive strategic planning process in practice. Planning is primarily carried out on an ad-hoc basis through contingency approaches, and there are instances where the company merely reacted to the changed dynamics in the industry instead of proactively planning for the repercussions of change beforehand. An example is the revision of regulatory import duties and tariffs on A/C components which significantly increased costs of production in FY 2009. The company could devise a strategy (such as maintaining a larger buffer inventory) to address such scenarios more effectively.

The company also relies on Planning Gap Analysis approaches to strategically deduce the desired objectives in the short, medium and long-term given the existing practical resources and capabilities of the firm.

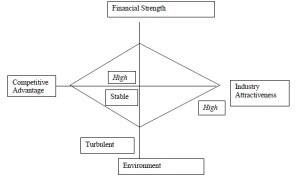

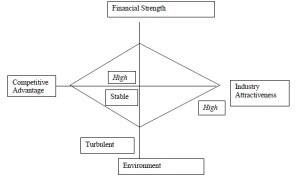

SPACE: Strategic Position & Action Evaluation:

The aforementioned SPACE Analysis reveals that Unitech offers a financially strong product, enjoying a competitive advantage in an attractive industry, operating in an environment which is relatively stable (but susceptible to turbulences). Therefore the strategic inclination of Unitech might be a Competitive Approach with cost reduction, productivity improvement, raising more capital to invest in opportunities and strengthen competitive edge. This aspect is apparent in the company’s strategy to reduce costs and price levels to stimulate demand and maximize growth. (Hunger & Wheelen, 2003)

Boston Consulting Group Growth-Share Matrix:

The following analysis focuses on depicting the products portfolio of Unitech on the BCG Market Growth/Share Matrix with relative market share on the horizontal axis, and potential growth on the vertical axis.

From the above analysis of BCG Matrix, it is evident that the Split, Cassette and Duct-type A/Cs are the product lines with highest market shares and growth rates. Duct-type centralized A/Cs are more widespread in the commercial/industrialized applications, with a high market share but a growth rate lower than that of Split or Cassette type versions. Window type A/Cs with high market shares is declining in popularity (negative growth rate) following the general trend of increasing popularities of split/cassette/duct type versions.

SWOT Analysis:

|

Strengths:

- Optimal Experience and Expertise of entrepreneurs in the HVAC Systems industry.

- Experienced pool of technicians and engineers with advanced levels assembling/manufacturing/trouble shooting skills and know-how.

- First business entity to have started manufacturing/assembling complete air conditioner units in Bangladesh.

- Core competencies arising from the vertical integration of supplier.

- In-house manufacturing/ testing/ troubleshooting equipments and facilities.

- Dedicated pool of staff enhances superior after-sales service providing.

|

Weaknesses:

- Strategic Planning not comprehensively carried out but done on an ad-hoc basis.

- Tunnel vision of the entrepreneurs e.g. lack of clear Integrated Marketing Communication Strategies.

- Financial Weaknesses arising from not being able to raise funds through issuing debt/equity securities in capital (or OTC) markets.

- Dependence upon Banks/other financial institutions for financing long-term investment projects.

|

|

Opportunities

- Demand for Air-Conditioners is increasing rapidly in the Bangladeshi context.

- The hot and humid tropical monsoon climate of Bangladesh renders A/Cs to be an indispensable requirement for indoor usages.

- The economic growth rate of the country has fostered the stimulation of demand for A/Cs.

- Economies of scale & usage of technological innovations have driven down costs, and made the products more affordable to the middle-class lower/medium income individuals.

- Introduction of schemes such as hire/purchase and payment through installments have rendered stimulated demand for A/Cs among lower-middle class.

- Symbiotic relationships with established corporate clientele; increasing chances of future repeat business, and expected revenue streams from providing services of installed systems.

|

Threats

- Revisions in the regulatory duty/tariff with respect to import of raw materials or A/C components.

- Fluctuations of Exchange Rates.

- Political turbulence in the country.

- Emergence new companies following similar business models (i.e. assembling domestically instead of importing the finished products)

- Emergence of conglomerates with massive financial investments.

- Probability of fierce price-wars predicted as competition increases.

- Rising inflation resulting in increased priced causing reduced demand.

|

The SWOT analysis is derived from the study of the external environment in which the business operates along with the assessment of internal core competencies (strengths) and weaknesses observed. The following section focuses upon the strategic implications of the SWOT analysis, and attempts to devise and suggest measures to address the imminent strategic issues.

Strategic Options & Recommendations

It can be intuitively deduced that ‘Market Penetration’, and ‘Market Development’ (as per the Ansoff’s Matrix) are contemplated to be the primary strategic maneuvers for sustainable growth for the next three years (Ansoff, 1980). Existence of untapped potential market segments can be observed, which might be strategically catered to with modified pricing offers and/or alternative modes of payment. Price elasticity is high in this industry, rendering growth achievable through revised pricing techniques. Growth can be fostered through installing capacity building measures (e.g. new capital machinery) to drive down costs of production and achieving increased productivity/efficiency. Therefore, further capital investments to manufacture components (currently imported) are deemed necessary to minimize cost of production.

Unitech might consider forming strategic alliances with banks or other financial institutions to allow their customers to enter into equal monthly installment (or direct debit) contracts to pay for Unitech A/Cs. This would ensure that Unitech generates increased steams of revenues through substantially expanding market share, as many customers would prefer such an arrangement. Shelf prices of A/Cs are still perceived to be relatively high by middle/lower income groups in Bangladesh, given the per capita income levels.

Promotional Strategies such as advertising to increase brand awareness is deemed vital, given the scenario of Unitech. The company’s senior management has overlooked the significance of effective integrated marketing communication efforts to enhance the long-term brand equity in its tunnel visions of absolute focus upon attaining increased operational efficiency. Although marketing expenditure would reduce profitability in the short-run, but its long-term repercussions in maximizing shareholder wealth can be considered to offset the initial tradeoff.

The dearth of financial resources can be mitigated through approaches of syndicated debt financing, achieved through a consortium of banks to participate in long-term lending schemes. Unitech possesses an impressive organizational Credit Rating, and should be able to secure such financing with its projected financial statements (i.e. future expected cash flows), and stable company fundamentals. This would enable requisite financing of investment projects (for capital machinery), and marketing communication expenses and provide leverage through tax-deductibility of debt financing.

Unitech might also consider forward Vertical Integration to acquire retailing/wholesaling companies to expand market reach, and foster growth. This strategy, however, is associated with uncertainty, and shifts from the core competencies of the firm. But the effort might render desired results for sustainable growth.

Scope for Product Development and Diversification is relatively limited, given the domestic outlook of the company. Development of new products is barely an option with the manufacturing constraints. Therefore, in the short and medium term, the focus should primarily be on Market Penetration and Market Development strategies, and in long-term the feasibility of expanding beyond the domestic market might be contemplated.

Conclusion

The level of complexity of the external and internal variables determining the performance of Unitech in the upcoming period of three years is relatively high. The company can strategically devise approaches to thrive through the challenges, or remain stagnant to suffer the negative consequences.

The inception and initial journey of the company had been an inspiring one, and if the company leaders can evolve as per the necessities, and grow organically as demanded by the imminent reality, it can be expected to succeed in the upcoming periods.

References:

Ansoff, H. I. (1980). Strategic issue management. Strategic Management Journal, 1(2), 131-148.

Hunger, J. D., & Wheelen, T. L. (2003). Essentials of strategic management. New Jersey: Prentice Hall.

Thompson, J. L., & Martin, F. (2010). Strategic management: awareness & change. Cengage Learning EMEA.

Unitech Products BD Ltd. (2010). Company Profile. Dhaka: UPBL

Westley, F., & Mintzberg, H. (1989). Visionary leadership and strategic management. Strategic management journal, 10(S1), 17-32.

Appendices:

Appendix-1 [Financial Statements]

Income Statement:

Figures in BDT ‘000

|

2010

|

2011

|

2012

|

| SALES |

160,000

|

240,000

|

320,000

|

| COST OF SALES: |

|

|

|

| RAW MATERIALS |

126,599

|

151,301

|

195,293

|

| DIRECT LABOR |

8,000

|

12,000

|

16,000

|

| MANUFACTURING OVERHEADS |

8,000

|

12,000

|

16,000

|

| DEPRECIATION |

15,714

|

15,714

|

15,714

|

| COST OF PRODUCTION |

158,313

|

191,015

|

243,007

|

| INVENTORY ADJUSTMENTS |

38,599

|

19,301

|

19,293

|

| TOTAL COST OF SALES |

19,714

|

171,714

|

223,714

|

| GROSS PROFIT |

40,286

|

68,286

|

96,286

|

| OPERATING EXPENSES |

|

|

|

| GENERAL & ADMIN. EXPENSES |

4,800

|

5,500

|

6,200

|

| SELLING EXPENSES |

8,000

|

12,000

|

16,000

|

| TOTAL OPERATING EXPENSES |

12,800

|

17,500

|

22,200

|

| OPERATING PROFIT |

27,486

|

50,786

|

74,086

|

| FINANCIAL EXPENSES |

|

|

|

| PROFIT ON TERM INVESTMENT |

2,870

|

1,031

|

9,193

|

| Profit On Working Capital Investment |

4,225

|

3,380

|

2,704

|

| TOTAL FINANCIAL EXPENSES |

17,095

|

14,411

|

11,897

|

| NET OPERATING PROFIT |

10,391

|

36,375

|

62,189

|

| OTHER INCOME |

100

|

100

|

120

|

| NET PROFIT BEFORE TAX |

10,491

|

36,475

|

62,309

|

| PROVISION FOR TAXES |

3,934

|

13,678

|

23,365

|

| NET PROFIT |

6,557

|

22,797

|

38,944

|

Balance Sheet:

Figures in BDT ‘000

| |

2010

|

2011

|

2012

|

| A. ASSETS |

|

|

|

| CURRENT ASSETS |

|

|

|

| Cash & Bank Balances |

306

|

600

|

7,160

|

| Accounts Receivables |

13,333

|

20,000

|

13,333

|

| INVENTORIES |

|

|

|

| Raw Materials |

21,266

|

31,900

|

42,533

|

| Finished Goods |

9,333

|

14,000

|

18,667

|

| Stores & Spares |

146

|

220

|

293

|

| Work in Process |

21,266

|

31,900

|

42,533

|

| Other Prepayments |

100

|

100

|

100

|

| Total Current Assets |

65,750

|

98,720

|

124,619

|

| FIXED ASSETS |

|

|

|

| Fixed Assets at Cost |

103,000

|

103,000

|

103,000

|

| Less: Accumulated Depreciation |

10,600

|

21,200

|

31,800

|

| Net Fixed Assets |

92,400

|

81,800

|

71,200

|

| OTHER ASSETS |

|

|

|

| Preliminary & Start-up expenses |

6,300

|

5,600

|

4,900

|

| Other Assets |

|

|

|

| TOTAL ASSETS |

164,450

|

186,120

|

200,749

|

| B. LIABILITY & EQUITY |

|

|

|

| CURRENT LIABILITIES |

|

|

|

| Accounts & Expenses Payable |

5,000

|

13,383

|

1,800

|

| Short Term Liability |

|

|

|

| Taxes Payable |

|

|

|

| Current Maturities of LTI |

35,700

|

42,800

|

50,000

|

| Total Current Liabilities |

40,700

|

56,183

|

51,800

|

| LONG TERM LIABILITIES |

|

|

|

| Bank’s Long Term investment |

80,000

|

60,000

|

40,000

|

| Other Long Term Investment, if any |

|

|

|

| Total Long Term Liabilities |

80,000

|

60,000

|

40,000

|

| TOTAL LIABILITIES |

120,700

|

116,183

|

91,800

|

| EQUITY |

|

|

|

| Paid-up capital |

31,000

|

31,000

|

31,000

|

| Retained Earnings |

12,750

|

38,937

|

77,909

|

| TOTAL EQUITY |

43,750

|

69,937

|

108,949

|

| TOTAL LIABILITIES & EQUITY |

164,450

|

186,120

|

200,749

|

Appendix-2 [Particulars of Directors]

| Particulars of Director |

Status in the Company

|

Extent of Shares |

| Penguin Engineering Ltd. Represented by Engr. Anis Ahmed |

Director

|

50% |

| Unitech Product PTE. Ltd., Singapore, Represented by Mr. Ong Chu Tek |

Director

|

50% |